In 2019, the documents that legal entities and individuals must use to offset and refund tax overpayments have changed. Let's take a look at what the application form for tax overpayment offset looks like now and how to fill out this document correctly.

Forms of applications used to offset and refund the amounts of overpaid (collected) taxes, fees, insurance premiums, penalties, fines, approved by order of the Federal Tax Service dated February 14, 2017 No. ММВ-7-8 / [email protected]. They should be used by both physical and legal entities. But since 2019, minor changes have been made to the order of the Federal Tax Service, which must be remembered.

According to article 78 of the Tax Code of the Russian Federation, taxpayers who have overpaid may dispose of the overpaid amounts in different ways:

These rules apply to all fees and taxes introduced in the Russian Federation, including state duty (with some features listed in article 333.40 of the Tax Code of the Russian Federation), VAT, advance payments. However, it must be understood that the tax service will not return or offset the overpaid amount against future payments until the debts are repaid.

If the taxpayer decides to redistribute his money, he needs to write an application for a tax offset. The form of this document is presented in the order of the Federal Tax Service from application number 9. You can download it at the bottom of the page.

Let's say Kolosok LLC filed a transport tax return for 2018, but made a mistake when paying it, paying 3,112 rubles more. The organization applies to the inter-district IFTS, asks for a credit for overpayment of taxes; the application writes that she would be credited with the overpaid amount on account of the upcoming payments on property tax of organizations. Consider step by step filling out such a document.

Step 1. Traditionally, at the very top, you should indicate the TIN and KPP. The IP identification number consists of 12 digits, so there should not be any free cells left. Organizations enter only 10 digits in the corresponding fields, dashes are placed in the remaining two. When filling out the line intended for the checkpoint, applicants must act in the same way: there are numbers - enter them, no - put dashes.

Step 2. We prescribe the number of the appeal. Here they put down the number of times in the current year they applied for offset. Do not forget about dashes if the number of digits entered is less than cells.

Step 3. Enter the code of the tax authority where the appeal will be sent. This should be an inspection of the Federal Tax Service at the place of registration of an individual entrepreneur or organization. In a consolidated group of taxpayers, the responsible member of this group must apply for the offset of the overpayment of income tax.

Step 4. We prescribe the full name of the applicant organization, for example, Kolosok Limited Liability Company. The remaining cells are filled with dashes. None of them should be empty. When filling in this field by an individual entrepreneur, he must indicate the last name, first name and patronymic, if any. In addition, you should indicate the status of the applicant, as whom he applies, in accordance with the instructions:

Step 5. We indicate the article of the Tax Code of the Russian Federation, on the basis of which offset can be made. It will depend on which payment was overpaid. The Federal Tax Service left 5 cells to indicate a specific article. If some of them are not needed, it is necessary to put dashes. Here are the options for filling out this field:

Step 6. We write down exactly why the overpayment was formed - tax, fee, insurance premiums, penalties, fines.

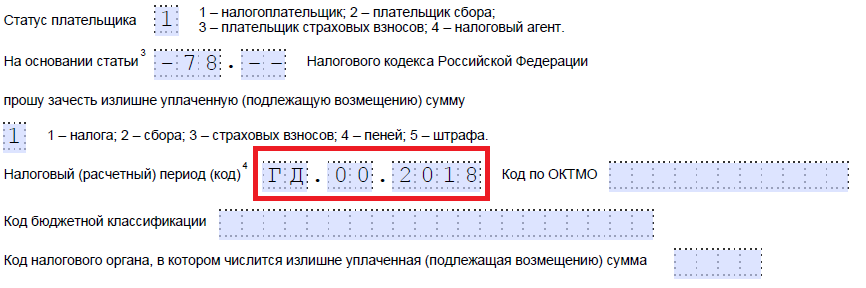

Step 7. The applicant specifies for what period the overpayment was formed. The developers provided 10 familiarity to indicate the code, of which there are two dots. The first two of them can be filled in with one of the following options:

Specific values will depend on the reporting period provided for by law for the payment for which the offset is planned.

In the 4th and 5th familiarity reporting period specified:

The last four characters are for a specific year, such as 2019.

Instead of alphanumeric combinations, a specific date can also be written, for example, 01/25/2019. Such an entry is allowed if the legislation provides for a specific date for the payment of a fee or for the submission of a declaration.

Examples of filling in the billing period: “MS.02.2019”, “Q.03.2019”, “PL.01.2019”, “DG.00.2019”, “05.04.2019”.

Step 8. Enter the OKTMO code. If you do not know it or have forgotten it, you can call the Federal Tax Service at the place of registration or on the nalog.ru website to find out the required code by the name of the municipality.

Step 9. Accurately enter the BCC for the payment of the corresponding payment, using the Order of the Ministry of Finance of Russia dated 06/08/2018 N 132n. You can also find out the code using the website of the Federal Tax Service or look at it on a previously completed payment order.

Step 10. We specify to which IFTS the excess funds were transferred.

Step 11. On the first sheet, it remains to fill in how many sheets the application is submitted on and how many sheets of supporting documents are attached, as well as indicate data about the applicant himself. We recommend leaving these two small sections for later.

Let's continue filling on the second sheet. In the very first field, where you want to specify the last name, first name and patronymic, we put dashes. Below we indicate what needs to be done with the overpayment - pay off the debt or leave funds on account of upcoming payments.

Step 12. We write down the specific amount that the applicant wants to set off. It is indicated in numbers, without text decoding.

Step 13. Fill in the period for the payment for which it is planned to offset. In our case, the corporate property tax is quarterly, so we enter the quarter in which the overpayment should go.

Step 14. We write down the OKTMO code again. As a rule, it is duplicated.

Step 15. We specify the CCC for the transfer of funds, to which the excess amount will go. In our country, it differs from the previous KBK, since taxes are different. If the overpayment goes towards future payments for the same fee, then the BCCs are the same. An exception in the event that the codes were previously changed by decision of the Ministry of Finance. We also recall that the offset can be carried out according to certain rules: they must belong to the same type: federal, regional or local. It is impossible, for example, to set off the federal part of income tax against future sales tax payments.

Step 16. The code of the IFTS, which accepts receipts, is usually duplicated.

Step 17. Since there are no more overpayments, in our example, the following lines are not filled. You can put spaces there. Also, organizations and individual entrepreneurs do not fill out the third sheet. It is intended for individuals, not registered as individual entrepreneurs, who did not indicate the TIN.

Step 18. We return to the first sheet and enter the number of pages and applications. In the fields provided, applicants indicate the relevant data.

Step 19. The last part of the application should not cause problems when filling out. Here it is necessary to clarify who and when submits the appeal, as well as indicate the contact phone number. The right part remains blank: it is intended for the marks of the inspectors of the Federal Tax Service.

If the entrepreneur (company) decides to return the amount of the overpayment, he needs to use another form from the order of the Federal Tax Service dated February 14, 2017 No. ММВ-7-8 / [email protected], proposed in Appendix No. 8. It contains a form for the return of an excess amount.

The rules for filling out this document are about the same. Therefore, we will not consider them in detail, but we will give an example of a completed document. Let's say Kolosok LLC overpaid VAT for the first quarter of 2019 in the amount of 15,732 rubles and now wants to return it. This is what the appeal of the head of the LLC will look like.

According to article 78 of the Tax Code of the Russian Federation, you can apply for a set-off and a refund within 3 years from the date the fee was paid. Documents can be delivered in three ways:

Having received such a statement, tax authority decides whether to satisfy him or not. The service notifies the entrepreneur of its decision within 10 days from the date of receipt of the application. As a rule, if the initiative comes from an organization or individual entrepreneur, the FTS makes a reconciliation of calculations. If the inspector himself discovers the overpayment, then the reconciliation may be refused. The entrepreneur is not released from the obligation to submit an application.

The rules for offsetting overpaid taxes are described in Art. 78 of the Tax Code of the Russian Federation.

Find out where the overpayment comes from and how it is detected.

By law, it is allowed to credit taxes of one type (at the same time, the CBC and the type of budget - the recipient of tax payments do not play a role):

It is also possible to use the set-off procedure for overpaid insurance premiums. Starting from 2017, it is allowed to offset only within one type of insurance premiums (for example, overpayments on contributions to the PFR can only be credited against future payments on them).

In order to set off, you need to take care of sending the controllers an application for offsetting the amount of overpaid tax. How to do this, we will tell in the next section.

The amount overpaid to the budget can be found by the taxpayer himself or supervisory authority. If the controllers were the first to find it, they are obliged to inform you about it in writing within 10 days from the date of establishing the fact of the overpayment (clause 5, article 78 of the Tax Code of the Russian Federation).

If you found the overpaid amount on your own, you need to send an application to the tax authorities for the offset. From January 9, 2019, the application form has changed. Now you need to use the form as amended by the order of the Federal Tax Service dated November 30, 2018 No. MMV-7-8 / [email protected]

Download form

Download form

Read about the rules for filing an application for a refund of a tax overpayment.

Below is a sample application form.

Download Sample

Download Sample

The application is considered by controllers, and the result is reported to the taxpayer:

Read the regulated form of the response of the tax authorities also as amended from 01/09/2019.

Download form

Download form

The offset is made by employees of the IFTS in which you are registered.

To set off the overpaid tax amounts, fill out an application. After the inspectors consider the application for offsetting the amount of overpaid tax, they will make an appropriate decision and inform you about it. Forms of documents involved in the document flow of the offset procedure are approved regulations tax department. From 01/09/2019, their forms have been updated.

I. Dubovik

No matter how clearly and harmoniously the accounting team works, no one is immune from errors in calculations with the budget. Overpayment of taxes, as well as underpayment, arises due to various reasons. For an accountant, it is important not so much to look for the culprit, but to take the necessary measures so that the overpayment does not have to be returned to judicial order. What needs to be done for this?

The presence of an overpayment is revealed by comparing the amounts of tax payable for a certain tax period with the amounts on payment documents relating to the same period, taking into account information about the taxpayer's settlements with budgets. In the event that facts are discovered that indicate a possible excessive payment of tax, at the suggestion of the tax authority or the taxpayer, a joint reconciliation of calculations for taxes, fees, penalties and fines may be carried out.

The taxpayer can also find out about the overpayment based on the results of an office or field trip. tax audit. The tax authorities are obliged to notify the taxpayer of each known fact of excessive payment of tax and the amount of overpaid tax within 10 days from the date of discovery of such a fact (clause 3 of article 78 of the Tax Code of the Russian Federation). But the auditors pay more attention to arrears, so it is better to identify the overpayment yourself. What action to take after that?

The actions of taxpayers and tax authorities in the event of detection of overpaid or collected amounts of taxes are devoted to Ch. 12 of the Tax Code of the Russian Federation. Issues of independent overpayments of taxpayers are regulated by Art. 78 of the Tax Code of the Russian Federation. There are only three options for using the amounts of overpaid taxes.

First of all, the option of offsetting tax arrears, penalties, fines is mentioned, since the budget will not return the overpayment of one tax if there is a debt on another. As for the second and third options, the taxpayer has the right to choose. In any case, the AC accountant needs to be well versed in all possible situations.

The forms of documents used by the tax authorities when offsetting and refunding amounts of overpaid (collected) taxes, fees, penalties, fines are approved by Order of the Federal Tax Service of the Russian Federation dated 03.03.2015 No. ММВ-7-8 / [email protected]

Set-off of amounts overpaid federal taxes and fees, regional and local taxes is carried out for the relevant types of taxes and fees, as well as for penalties accrued on them (paragraph 2, clause 1, article 78 of the Tax Code of the Russian Federation). In other words, the offset is made for taxes of one level of administration. So, an overpayment on one federal tax (for example, income tax) is credited towards repayment of arrears on another federal tax (say, VAT), or an overpayment on one regional tax (for example, property tax) can be credited towards repayment of underpayment on another regional tax (for example, transport tax). As far as local taxes are concerned, this land tax and trade tax, the payer of which is more often trade organizations. Therefore, an overpayment of the land tax can only be credited against the payment of future payments on this tax. The offset of taxes of different levels (federal and regional, or local) is not allowed by the above rule.

Separately, it must be said about personal income tax. This is a federal tax for employees of an institution - individuals, while the institution itself in this case acts as a tax agent. Therefore, to count the overpayment of income tax or VAT against the underpayment of personal income tax body will not be (Letter of the Ministry of Finance of the Russian Federation dated February 19, 2010 No. 03-02-07 / 1-69).

The accountant does not need to submit an application for offsetting the overpayment of one tax against the arrears in another, since the tax authority will independently perform the offset based on the provisions of paragraph 5 of Art. 78 of the Tax Code of the Russian Federation. In a different way, you need to act in a situation where the amount of the overpayment is sent to pay off debts for penalties and fines. To do this, the taxpayer must submit a written application or an application sent in electronic form. Within 10 days from the date of receipt of the said application, the tax authorities make a decision on offsetting the amount of overpaid tax towards repayment of debts on penalties and fines (paragraph 3, clause 5, article 78 of the Tax Code of the Russian Federation).

Tax arrears, fines and penalties are considered paid from the day the tax authority decides to set off the overpayment amounts (clause 4 clause 3 article 45 of the Tax Code of the Russian Federation).

If there are no arrears on other taxes, and there is also no debt on penalties or fines, then the taxpayer can direct the overpayment towards the payment of future payments to the same tax or other taxes (clause 4 of article 78 of the Tax Code of the Russian Federation). This offset is made by the tax authority on the basis of the taxpayer's application, which can be submitted to the inspection in electronic form. The term for offsetting the overpayment of tax against future payments is 10 working days from the date of receipt of the application or from the date of signing the act of reconciliation of taxes paid by him, if such a joint reconciliation was carried out.

At the same time, the act of reconciliation with the tax authority of settlements with the budget, in which the amount of the overpayment is fixed, in isolation from other documents, is not an unconditional proof of the overpayment, and the date of its compilation is not considered the starting point for determining the statute of limitations for going to court. If the fact of excessive payment of tax and fine became known from the letter of the inspectorate to the taxpayer, then it is from this date that the period limitation period to apply to the court (three years). After the pass this period the court may refuse to set off the overpayment against other obligations (Resolution of the Arbitration Court of the Moscow Region dated September 28, 2015 No. F05-12690 / 2015).

You have to apply to the court when a dispute arises between the taxpayer and the tax authority on the issue of offsetting the amounts of overpaid taxes due to disagreements on the amount of the overpayment. If the taxpayer believes that as a result of the decision by the tax authority to refuse to set off the overpaid amounts against the repayment of the arrears he has, his rights have been violated, he is also entitled to challenge the said decision in court (paragraph 80 of the Decree of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 30, 2013 No. 57).

Recall: the return to the taxpayer of the amount of overpaid tax in the presence of arrears on other taxes of the corresponding type or debt on the relevant penalties, as well as fines subject to collection, is made only after offsetting the amount of overpaid tax to pay off the arrears (debt) (paragraph 2 clause 6, article 78 of the Tax Code of the Russian Federation).

The condition for the return of overpaid tax is the proper observance by the taxpayer of the procedure regulated by Art. 78 of the Tax Code of the Russian Federation: the amount of overpaid tax is subject to refund at the request of the taxpayer within one month from the date of receipt by the tax authority of such an application (Letter of the Ministry of Finance of the Russian Federation dated 07.10.2015 No. 03‑02‑08/57177). At the same time, sending this application to the tax authority is the right, and not the obligation, of the taxpayer, who may refuse to return the tax by using the overpayment in another way (Letter of the Ministry of Finance of the Russian Federation of December 11, 2014 No. 03‑07‑11/63803). In addition to the application, you must submit documents proving the existence of an overpayment. Such documents include tax declarations (calculations), payment documents confirming the payment of tax, explanations of the reasons for excessive payment, and other evidence.

An application for the refund of the amount of overpaid tax can be submitted within three years from the date of payment of the specified amount (clause 7, article 78 of the Tax Code of the Russian Federation). According to the Supreme Court, expressed in Ruling No. 306-KG15-6527 dated 03.09.2015, the grounds for the refund of overpaid income tax arise from the date of submission tax return for the corresponding year, but no later than the deadline established for its submission to the tax authority. It is from this moment that the three years allotted for submitting an application for a tax refund should be counted.

The very amount of overpaid tax is subject to refund within one month from the date of receipt by the tax authority of the application from the taxpayer (Clause 6, Article 78 of the Tax Code of the Russian Federation). When the fact of excessive payment of tax is established by the tax authority during the desk audit, the period for the tax refund begins to be calculated after the expiration of the period allotted for a desk audit or from the day the desk audit is completed if it is completed ahead of schedule (letters of the Ministry of Finance of the Russian Federation dated 15.10.2015 No. 03-04-05 / 59032, dated 07.10. -08/57177).

By the way, for the delay by the tax authority of the return of overpaid tax, the taxpayer has the right to demand additional amount in the form of percentages. They are subject to payment to the taxpayer for each calendar day of violation of the return period based on the refinancing rate of the Central Bank of the Russian Federation, which was in force on the days of the violation of the return period (clause 10, article 78 of the Tax Code of the Russian Federation). When calculating the amount of interest, the following should be taken into account (Letter of the Ministry of Finance of the Russian Federation of October 29, 2014 No. 03‑02‑08/54846):

- when determining the delay period - the actual number of calendar days of delay, taking into account the day of the actual tax refund (receipt of funds to the bank),

- when determining the interest rate - the refinancing rate of the Central Bank of the Russian Federation, which was in effect on the days of violation of the compensation period, divided by the number of days in a year (365 or 366).

The monthly tax refund period is not as long as it seems, so the accountant should not forget about the sanctions that can be applied to slow taxmen.

If we talk about federal taxes, then you should start with income tax. Chapter 25 of the Tax Code of the Russian Federation does not contain special rules on the return of overpayments for this tax, but at the same time there are reference rules to Art. 78 of the Tax Code of the Russian Federation. Moreover, it is not worth rushing to return the overpayment, since advance payments are made during the year, which can be considered overpaid only at the end of the tax period.

As for VAT, if at the end of the tax period the amount tax deductions exceeds the amount of tax payable to the budget, then the amount of tax is reimbursed to the taxpayer according to the special rules established by Art. 176 of the Tax Code of the Russian Federation. If the overpayment of VAT was formed due to the fact that the taxpayer himself paid the excess amount, the tax refund is made in accordance with the provisions of Art. 78 of the Tax Code of the Russian Federation (Resolution of the FAS SZO dated May 20, 2013 No. A21-6518 / 2012).

In contrast to the above taxes, for the return of personal income tax, it is provided special order: overpayment of tax incurred by the taxpayer-employee as a result of the actions of the tax agent-employer, taking into account the priority of special norms over general ones, is subject to return in a special order established by Art. 231 of the Tax Code of the Russian Federation (Letter of the Federal Tax Service of the Russian Federation dated July 17, 2015 No. SA-4-7 / [email protected]).

This procedure consists in the fact that the taxpayer returns the tax through a tax agent who returns personal income tax on the basis of a written application from the person from whom the tax was excessively withheld. The tax agent is obliged to inform the taxpayer about each fact of excessive tax withholding and the amount of excessive tax withheld within 10 days from the date of discovery of such a fact.

Within three months from the date of receipt by the employer of the employee's application, the excess withheld tax must be credited to his bank account (paragraph 3, clause 1, article 231 of the Tax Code of the Russian Federation).

The tax agent does not need to wait for the tax authority to return the overpaid personal income tax for the employee. The refund of the amount of tax withheld to him is made by the tax agent at the expense of the amounts of this tax to be transferred to budget system on account of upcoming personal income tax payments for all employees of the institution.

If this amount is not enough to return the excess withheld and transferred amount of personal income tax, the tax agent, within 10 days from the date the taxpayer submits the relevant application to him, sends an application to the tax authority at the place of his registration for the return to the tax agent of the excess tax withheld by him. The indicated procedure is carried out according to the general norms of Art. 78 of the Tax Code of the Russian Federation.

Together with an application for the return of the amount of personal income tax withheld and transferred to the budget system, the tax agent submits to the tax authority an extract from the register tax accounting for the tax period and documents confirming the excessive withholding and transfer of the amount of tax. Until the return of the excess withheld personal income tax from the budget, the tax agent has the right to return it at his own expense (Resolution of the Ninth Arbitration Court of Appeal of November 19, 2014 No. 09AP-46626/2014).

At any tax reporting there is a place to indicate data, how much is accrued to the budget and how much is paid. Therefore, if the accountant made a mistake in drawing up the payment order, then it is enough for him to reflect this in the amounts paid. The negative difference between the accrued and paid tax will just show the overpayment, which must be dealt with in the manner described above. The situation becomes more complicated when it comes to overestimation tax base or tax calculation that led to excessive "funding" of the budget. In this case, the procedure for adjusting tax liabilities in declarations for each tax is individual.

income tax. The most common situation of overstating the tax base is the expenses incurred that are not taken into account in reducing the income received. In the income tax return, the form of which is approved by the Order of the Federal Tax Service of the Russian Federation dated November 26, 2014 No. ММВ-7-3 / [email protected], in Appendix 2 to sheet 02, which indicates the costs associated with production and sales and non-operating expenses, there is a place for information on adjusting the tax base for identified errors (distortions) related to past tax periods leading to overpayment of taxes. Moreover, several lines are provided for this (400, 401, 402, 403), if there are several errors and they refer to several previous tax periods. Please note that in this way it is possible to reflect both previously unaccounted expenses and overly recognized income, which are already recognized as current expenses. As such, the adjustment for prior period overpayments adjusts the current period's tax base on sheet 02, in the main tax calculation.

The described procedure for adjusting the tax base in a “profitable” declaration is nothing more than the implementation of the norm of para. 3 p. 1 art. 54 of the Tax Code of the Russian Federation, which allows correcting by the current reporting period the mistakes (distortions) made earlier, which led to the excessive payment of tax. As a result, the old overpayment is offset against today's tax. The same principle is implemented in the reporting of other taxes.

VAT. In the declaration for this tax, the form of which is approved by the Order of the Federal Tax Service of the Russian Federation of October 29, 2014 No. ММВ-7-3 / [email protected], there are many fields for specifying various adjustments, more related to issuing and receiving an adjustment invoice, which can either increase or decrease shipment (volume and cost of sales of goods, works, services). Another reason for self-adjustment of the tax base is the use of non-market prices for controlled transactions with related parties, which leads to an increase in the seller's tax liabilities and, accordingly, to a decrease in them from the buyer. However, the latter cannot correct them in lines 105 - 109 of sec. 3 declarations.

The overpayment of tax as a result of using a smaller deduction is not the result of an underestimation of the tax base, but a decrease in the very calculation of the tax payable. It is unacceptable to apply par. 3 p. 1 art. 54 of the Tax Code of the Russian Federation to tax adjustment by declaring tax deductions (Determination of the Supreme Court of the Russian Federation of August 28, 2014 No. 306-ES14-631). And for errors with deductions relating to previous periods, the tax amount is recalculated for the period in which the errors were made (clause 1, article 54 of the Tax Code of the Russian Federation). As a result, when tax is overpaid by not declaring deductions (for example, due to documents received late), the accountant simply needs to submit an updated VAT return for the period in which excessive tax was charged related to tax deductions declared in a smaller amount.

personal income tax. When calculating this tax autonomous institutions act as tax agents who, since 2016, have been reporting under new forms (2-NDFL and 6-NDFL), approved by orders of the Federal Tax Service of the Russian Federation of October 30, 2015 No. ММВ-7-11 / [email protected], dated October 14, 2015 No. ММВ-7-11/ [email protected] In the first form in the last section. V, where are shown total amounts income and tax, there is a field for indicating the amount of personal income tax not returned by the tax agent. In the second reporting document, filled out for all employees who received income, there is a place to indicate the personal income tax returned by the tax agent in accordance with the rules of Art. 231 of the Tax Code of the Russian Federation. Thus named reporting forms complement each other. From the first one, you can find out how much a particular taxpayer has overpaid, and from the second one, whether the tax agent has fulfilled the obligation to return the excess withheld tax. Considering that the forms are drawn up in a different format (2-personal income tax for each employee, and 6-personal income tax for the whole staff of the institution), you need to be prepared to bring them to a common denominator in tax register for personal income tax, which is developed independently.

"Elimination" of overpayment of taxes is not such a simple procedure as it might seem at first glance. Therefore, the AC accountant needs to try to avoid excessive transfer of tax, but if this still happened, then you should not panic, but you just need to consistently perform all the actions described in the article, and then the overpayment will not be lost and will not hang on the personal account, but will be used with benefit.

Material publication date: 07/26/2019

Last update: 07/26/2019

We'll show you how to get your tax refund back.

First of all, let's deal with the terms: what is Russian legislation What is meant by tax overpayment? To answer this question, we need to turn to tax code Russian Federation: Art. 78 of the Tax Code of the Russian Federation indicates that the amount of overpaid tax is the amount paid by the taxpayer in the absence of his obligation to pay it.

What to do if you find such an overpayment? To date, the amount of overpaid tax can be used in the following ways:

The main features of the tax refund procedure include the following:

No one is insured against overpayments in taxes - such a problem can arise both for an individual and for individual entrepreneur or organizations. Why is this happening? Based on practice, we can say that tax overpayments most often occur in the following cases:

How to find out about a tax overpayment? Required Information you can find in the Taxpayer's Personal Account on the official website of the Federal tax service.

The “Overpayment / Debt” tab will contain all the information about both your debts and overpaid amounts.

If you want to return the tax overpayment yourself, we recommend that you follow the following algorithm:

When submitting your application, be sure to include the following information:

At this stage, you will be required to collect all the documents that can confirm the fact of a tax overpayment (the exact list of documents depends on the specific situation).

By general rule an application for the refund of a tax overpayment is submitted to the tax authority at the place of residence of the taxpayer.

If you do not know which tax office your home address is attached to, we recommend using the service "Determining the details of the IFTS" on the website of the Federal Tax Service.

Note! The above recommendations are not exhaustive, since each case is unique and requires a personal approach. If you need additional advice, you can get on our website.

1. Offset of overpayment against tax debts, penalties, fines

First of all, the amount of the tax overpayment is subject to offset against the repayment of arrears on other taxes, debts on penalties and fines. It is not necessary to submit an application for such a set-off, since the tax authority will make a set-off on its own. From the day the inspectorate decides to set off the arrears, penalties, fines are considered paid (clause 4 clause 3, clause 8 article 45, clause 5 article 78 of the Tax Code of the Russian Federation).

2. Offset of overpayment against future tax payments

To offset the amount of the overpayment of tax against future payments for this or other taxes, an application must be submitted to the tax authority (clause 4, article 78 of the Tax Code of the Russian Federation).

An overpayment can only be set off against the payment of tax (tax penalties) of the same type (clause 1, article 78 of the Tax Code of the Russian Federation). So, for example, an overpayment of a local tax can only be offset against the payment of this or another local tax (interest on them).

Reference. Types of taxes in the Russian Federation

So, in particular, federal taxes include personal income tax (PIT); to regional - transport tax; to local - land tax and tax on property of individuals (Articles 13-15 of the Tax Code of the Russian Federation).

Example. The procedure for offsetting the overpayment of land tax against the arrears of other taxes

The citizen has an overpayment on land tax and arrears on property tax of individuals and transport tax.

It is possible to set off the overpayment of land tax against the arrears in personal property tax, since both taxes are local. It is impossible to set off the land tax overpayment against the transport tax arrears, since the transport tax is regional (Articles 14, 15, Clause 1, Article 78 of the Tax Code of the Russian Federation).

The fact that the objects of taxation for personal property tax, land and transport taxes are located in different regions ( municipal areas or urban districts), does not matter.

Example. The procedure for offsetting an overpayment on the property tax of individuals against arrears on other taxes

The citizen owns two apartments located in Moscow, and land plot located in the Moscow region. A citizen has an overpayment of personal property tax and a land tax arrears. Since the arrears arose for the same type of tax, then, despite the fact that the objects of taxation are located in different regions, the overpayment of property tax can be set off against the repayment of arrears on land tax (Article 15, Clause 1, Article 78 of the Tax Code of the Russian Federation) .

Note!

An overpayment of tax can be offset against the payment of a fine without taking into account the type of tax and regardless of the specific type tax offense(P.

1 st. 78 of the Tax Code of the Russian Federation).

3. Refund of the overpayment amount to the bank account

To return the overpayment amount to a bank account, you must submit an application to the tax authority (clause 6, article 78 of the Tax Code of the Russian Federation).

4. The procedure for applying to the tax authority with an application for a set-off or refund of an overpayment

The period during which it is possible to claim a credit or refund of an overpayment is three years from the date of payment of the tax (clause 7, article 78 of the Tax Code of the Russian Federation).

You need to apply to the tax authority at the place of your registration with a written application for a set-off or refund of the overpayment. An application can be submitted in person or through a representative directly to the tax authority, sent by mail or transmitted in electronic form, in particular through the taxpayer's personal account (clause 1, article 26, clauses 2, 4, article 78 of the Tax Code of the Russian Federation).

The Inspectorate must make a decision to set off or return the overpaid amount within 10 working days from the date of receipt of the application or signing of the act of joint reconciliation of settlements, if such a reconciliation was carried out. Then within five working days tax office send you a message about decision. The refund of the overpayment to your bank account must be made within one month from the date of receipt of the above application (clause 6, article 6.1, clauses 6, 8, 9, article 78 of the Tax Code of the Russian Federation).

In case of violation of the tax refund deadline, the inspection is obliged to pay you interest for each day of delay, which is charged on the amount of the overpayment based on the refinancing rate of the Bank of Russia that was in force at that time (clause 10, article 78 of the Tax Code of the Russian Federation).

If you believe that the tax inspectorate violated your rights during the procedure for offsetting (refunding) the overpayment, you have the right to appeal against the decisions of the inspectorate, actions or inaction of its officials to a higher tax authority and (or) to the court. At the same time, you can apply to the court only after contacting the FTS. The deadline for filing a complaint is a year with the Federal Tax Service, and to the court - three months from the day you became aware of the violation of your rights (Article 137, paragraphs 1 - 3 of Article 138, paragraphs 1, 2 of Article 139 of the Tax Code of the Russian Federation, Part 1 of Article 219 of the CAS of the Russian Federation).

Related questions

How is land tax calculated for individuals? >>>

How is the transport tax for individuals calculated? >>>

Useful information on the issue

Official website of the Federal Tax Service - www.nalog.ru

9. Offset (refund) of overpaid

amounts of taxes, penalties and fines

According to new edition The Tax Code of the Russian Federation applies the procedure for offsetting overpaid amounts to advance payments and fines. Therefore, it is now possible to apply for a set-off (refund) of overpaid advance payments and fines. For advance payments, the procedure for applying a set-off (refund) was also extended by the courts earlier (see clause 10 of the Information Letter of the Presidium of the Higher Arbitration Court RF of December 22, 2005 N 98), now this is enshrined in clause 14 of the Tax Code of the Russian Federation.

The tax authority is obliged to inform the taxpayer about each fact of excessive payment of tax and the amount of overpayment of tax that has become known to him within 10 days, and not within a month, as before. But the Tax Code of the Russian Federation still does not establish any consequences of violation of this deadline by the tax authority. Therefore, the tax authorities are unlikely to notify the taxpayer of each fact of overpayment, and it is better to track the overpaid amounts on your own.

After a tax overpayment is discovered, it is possible to conduct a reconciliation, which can be declared by both the tax authority and the taxpayer (previously this right was granted only to the tax authority). The results of this reconciliation must be formalized in an act (paragraph 2, clause 3 of the Tax Code of the Russian Federation). Note that the value of reconciliation is the definition of a specific amount of overpayment. However, this does not mean that in the future the taxpayer cannot apply for a larger offset if, after the reconciliation, it turns out that the overpayment arose in a larger amount. In addition, the presence of a reconciliation act is not a prerequisite for offsetting or returning an overpaid amount. The tax authority is not entitled to refuse to carry out a set-off (refund) only on the grounds that there is no reconciliation act (see FAS Central District No. A14-2583-03/109/24 dated November 28, 2003;

The offset of overpaid amounts of tax against future payments on this or other taxes will continue to be carried out on the basis of a taxpayer's application. You can apply for credit within three years from the date of payment. Previously, this period was not specified in the Tax Code of the Russian Federation, however judicial practice the opinion was maintained that the period was three years, as well as for filing an application for a refund of overpayment (see Presidium of the Supreme Arbitration Court of the Russian Federation of 06.29.2004 N 2046/04). Now this term is set right in.

The deadlines for offsetting against future payments have increased: instead of the previous 5 days, the tax authority can make a decision within 10 working days from the date of receipt of the application or from the date of signing the reconciliation act (if reconciliation was carried out) (clause 4 of the Tax Code of the Russian Federation).

The new version of Clause 5 of the Tax Code of the Russian Federation gives the tax authority the right to offset tax overpayments against arrears on other taxes, as well as debts on penalties and fines independently within 10 working days from the date of discovery of the overpayment, or signing of the reconciliation act (if reconciliation was carried out), or the entry into force of the court decision. The previous version of clause 5 of the Tax Code of the Russian Federation allowed the tax authority to independently set off the overpayment only towards the repayment of tax arrears. An overpayment of tax could not be sent to pay off the arrears in penalties without a corresponding application from the taxpayer (see FAS of the West Siberian District of December 05, 2005 N F04-8679 / 2005 (17509-A27-35), FAS of the North-Western District of January 11 .2006 N A05-8548/2005-12 and others).

At the same time, according to par. 3 clause 5 of the Tax Code of the Russian Federation, in this case, the taxpayer has the right to independently submit a written application for offsetting the amount of the overpayment towards repayment of arrears (debts on penalties and fines). Consequently, in the presence of such an application, the tax authority will not be able, in accordance with paragraph 5 of the Tax Code of the Russian Federation, to set off the overpayment towards the repayment of other debts of the taxpayer.

The new version of the Tax Code of the Russian Federation still does not directly regulate the issue of the possibility of offsetting overpayments against future payments in the presence of arrears. If the taxpayer submits an application for the offset of future payments, the tax authority, based on clause 5 of the Tax Code of the Russian Federation, can carry out such a offset, but only for the amount remaining after the arrears are paid off. However, paragraph 4 of the Tax Code of the Russian Federation does not provide for such a restriction. Therefore, further disputes on this issue are possible.

Beginning January 1, 2008, the procedure for offsetting overpaid amounts will change. It will be made according to the relevant types of taxes and fees (and not budgets, as it is now). Federal taxes will be credited against federal taxes, regional taxes against regional taxes, and local taxes against local taxes (paragraph 2, clause 1 of the Tax Code of the Russian Federation).

For example, corporate income tax is federal tax(clause 5 of the Tax Code of the Russian Federation), however, it is paid to two budgets: federal and regional (clause 1 of the Tax Code of the Russian Federation). If now, for example, an overpayment of income tax can be offset against VAT arrears only in the part in which the overpayment is credited to federal budget, then after January 1, 2008, it will be possible to send the entire amount of the overpayment on income tax to pay off VAT arrears, since both taxes are federal. The reverse situation is that it is now possible to set off an overpayment on income tax against the arrears on property tax of organizations (in the part in which the overpayment is credited to regional budget). After January 1, 2008, it will not be possible to direct the overpayment of income tax against property tax arrears, since income tax is federal, and corporate property tax is regional (clause 1 of the Tax Code of the Russian Federation).

The deadline for refunding the overpaid amount of tax has not changed. The refund of the overpaid amount of tax is still carried out within a month from the date of receipt of the taxpayer's application. But the deadlines for making a decision on the return and sending an order for the return of the tax to the territorial body are stipulated. Federal Treasury(within 10 working days from the date of receipt of the application or verification). Previously, these terms were not set. As before, if the tax is not returned after a month from the date of receipt of the application for a refund, interest is charged on the amount of the returned tax for each calendar day of delay. However, now, in accordance with the procedure provided for, and Art. 78 of the Tax Code of the Russian Federation, interest for late return is calculated after the expiration of a month from the date of submission of the application and until the day of the actual return cash to the taxpayer's account.

Clause 13 of the Tax Code of the Russian Federation establishes that the offset and return of overpaid taxes and the payment of accrued interest are made in the currency of the Russian Federation.

Transitional provisions

From January 1, 2007 and until January 1, 2008, the amounts of overpaid taxes, fees, penalties and fines are returned (offset) at the expense of the amounts to be transferred to the relevant budget (and Article 7 federal law dated July 27, 2006 N 137-FZ). That is, until January 1, 2008, tax payable to the federal budget, such as VAT, can only be credited against the overpayment of tax payable to the federal budget (VAT, part of income tax, etc.). After this date, federal taxes will be credited against federal taxes (for example, income tax against UST), regional against regional taxes (for example, corporate property tax against transport tax) and local at the expense of local.

The offset (refund) of overpaid tax amounts before January 1, 2007 will be carried out according to the rules in force until 2007 (clause 9 of Federal Law No. 137-FZ of July 27, 2006). Therefore, the new rules (new deadlines for offsetting, the right of the tax authority to independently offset overpayments against arrears of penalties and fines) will be applied only if the amount to be offset (refunded) was paid after December 31, 2006.

At the same time, in No. 03-02-07/2-54 dated March 21, 2007, the Ministry of Finance of the Russian Federation clarified that the new ones and the Tax Code of the Russian Federation provide an additional guarantee of protecting the rights of taxpayers and, according to the Tax Code of the Russian Federation, have retroactive effect. This is expressed as follows. Interest is charged to the taxpayer for each day of delay. However, since the return procedure itself takes some time, interest may not be paid in full (excluding the days that have passed from the moment the decision was made until the actual return). Therefore, the Tax Code of the Russian Federation establishes that the tax authority in this case must independently decide on the return of the remaining amount of interest.

This amount is calculated on the basis of the date of the actual refund to the taxpayer of the amounts of overpaid (collected) tax. Consequently, when returning to the taxpayer amounts overpaid (or collected) before January 1, 2007 (if the deadline for their return was violated), the tax authority is also obliged to independently decide on the return of the remaining amount of interest calculated on the day of the actual return.

The amount of the overpayment paid before January 1, 2007 in foreign currency and subject to offset (return) after December 31, 2006, will be returned (offset) in rubles. The recalculation must be made on the day of the excess payment (clause 11 of the Federal Law of July 27, 2006 N 137-FZ).