Cashless payments, payment for services via the Internet, shopping without leaving home, accrued salary - all these advantages are provided by bank cards. Kinds bank cards are very different, therefore, their differences should be understood. Opening a bank account in our age is very simple: just come to the bank, conclude a contract and receive a personalized card, which can later be used to pay for any services. In addition, banks often offer various bonuses to make life even more comfortable!

Since the last century, the presence of a bank account has been considered a sign of a rich person. Indeed, in order to start it, a considerable initial amount was required, which the bank kept. In the 50s, the first bank card appeared, which, in fact, is a sign that a person is a regular customer and keeps his savings in this particular financial institution. Later, this idea was developed, and in our time, any citizen can afford to get a bank card without any risk. Now, having a bank account does not mean that a person has a lot of money, and fraudsters will have to try hard to steal all the funds and data from it, because a unique chipset is built into each card, and the account owner knows the code word for data encryption. In extreme cases, the card can simply be instantly blocked from the moment the disappearance of funds on it is detected. In general, this thing is convenient in our time - bank cards. The types of bank cards are now very diverse, and for people who decide to get one for the first time, it can be difficult to decide which card is right for them. This is what should be dealt with.

In essence, no matter what banks say and no matter what advertising company they push regarding cards, by and large there are only two types of cards:

What is the specific benefit for each type of card? You should start with the fact that it all depends on your wealth and the purposes for which the cards are needed.

A debit card is great for:

If you are a person who is quite frugal with money and likes to save it for a specific purpose, then you should no longer shove money on mattresses and be afraid of night hunters for other people's wealth, nowadays it is enough to have a smartphone and a bank card in order to fully protect your funds. A debit card is, in essence, a key to your electronic accounts, which is very convenient to take with you on any trip. Also, many companies give their employees initial bank cards for payroll, which is also very convenient.

What are the advantages of a credit card? For the most part, it is just one thing: a credit card is indispensable when, for some reason, funds are urgently needed, and the card has a zero balance. In this case, you can borrow from the bank and pay for the desired purchase or services. In essence, every month a person takes a mini-loan, and then gives the money to the bank from his salary. When issuing a credit card, the client undertakes to provide the bank with truthful information about his income.

Customers often hear this word from bank employees. And of course, it introduces a little confusion. So, don't stress.

Allowed overdraft cards are just another name for credit cards, where an overdraft refers to a negative balance in a customer's account. In fact, the bank allows the client to go negative up to a certain amount, if for some reason he does not have enough of his own funds on the card.

The limit on spending is set at the conclusion of the contract, while it is important for the bank to know the level of income of its client.

Important! The higher the level of the client's card, the lower the percentage of the loan he can afford.

These two payment systems often flash before our eyes, despite the fact that, in addition to them, there are others. Nevertheless, when concluding a contract with a bank, you should decide which payment system the bank cards will be linked to.

Types of bank cards are not critically different when it comes to choosing payment systems. In particular, it is only a matter of currency conversion and where the client most often visits. For example, an ordinary Sberbank bank card is accepted almost everywhere, paying for any services abroad, the client does not have to worry about whether he has a Visa or a MasterCard.

Nevertheless, there are differences between them, namely:

When purchasing a card, you should ask what kind of partners the bank has abroad, what bonuses should be expected based on the data received and personal experience, choose the appropriate card.

Banks often allow one owner to hold several cards at once, while one of them can be issued to the owner himself, while the other - to some family member or even be anonymous.

A good example of a prepaid card is gift card, which can be used once, and after its use, just throw it away. Transport, social, salary or even game cards are all types of this kind of plastic. They are absolutely anonymous, their scope of action is most often limited to one service.

Very virtual cards from various payment systems are widespread: Qiwi, WebMoney, Yandex.Money, which are also common only for a certain range of services.

Prepaid cards can also be limited in time of use, they have a fixed amount for any needs, and often they can only be paid in certain places.

To issue a card, a citizen of the Russian Federation needs to come to the bank with his passport and conclude a contract for issuing a card. If you are applying for a bank loan, you must also provide proof of income.

It happens that a person wants to get a premium class card, that is, he claims to obtaining a Visa Cold or Platinum, however, it should be remembered that banks do not issue such cards to customers with a missing financial history in a bank or those who have credit history negative.

Often, the production of a personalized card takes about a week in general, after which the cherished plastic personalized bank cards fall into the hands of the client.

Types of bank cards may differ by age categories of the client. For example, a Sberbank youth bank card is issued to all persons from 14 to 25 years old. At the same time, there are no special restrictions on the map.

You should also check with the bank office how much the monthly or annual maintenance bank, what percentage per annum for storing certain amounts are waiting for you, as well as what services are connected to the card.

To find out some information, it is not at all necessary to call the office every time. Now every self-respecting bank has mobile app, by setting which, the user himself controls his expenses, saves amounts for the necessary purposes, sees how many bonuses he has accumulated for purchases, creates automatic payments and, best of all, an automatic notification is sent to the phone about each operation.

For example, a father of a family who has one bank account and several cards: one is issued for him, the second for his daughter, the third for his wife, can easily monitor the expenditure of funds. Or, when issuing prepaid cards for someone, the owner can also see where the money from the card was spent.

Nowadays, various cashback services are also very popular when shopping in online stores. It's always nice to get back some percentage of the purchase! Now it’s even easier to do this: many banks offer to activate cashback right when applying for a card, without intermediary services, and when buying goods in partner stores, a small part of the amount spent is automatically returned to the card.

Also, for those who like frequent flights, there is a system of accumulating miles, as a result of which you can save up for a small trip to any city in Europe. International bank cards are often useful when there is no way to change money, and besides, making purchases abroad in the same stores as at home, or dining in the same restaurants, you can get bonuses from the bank.

The advantages of bank cards do not end there. AT modern world a person can profitably do what he loves, receiving pleasant bonuses from his bank for this.

Editorial responseBank cards can be used to pay for any goods and services, as well as to withdraw cash. The owner is the bank that issued the card, and the holder is the bank's client.

Depending on the place of application, the cards can be local, international and virtual.

Local cards are intended for transactions in the system of the bank that issued the card. You can withdraw money or pay for a service / goods with such a card only at ATMs and terminals of this bank. Also, using such a card, it is impossible to carry out transactions on the Internet, with the exception of operations on the website of the issuing bank, if it provides such an opportunity. These cards are now quite rare.

International bank cards are cards of international banking systems. The most popular are Visa systems and MasterCard. Cards of these systems are of several types and differ in their functionality. With such cards, you can withdraw cash from ATMs and terminals around the world (with a commission). You can also pay for purchases via the Internet. International bank cards are used in international systems payments. The most popular are Visa (Visa Electron, Visa Classic, Visa Gold, Visa Platinum), MasterCard (Cirrus, Maestro, MasterCard Standard, MasterCard Gold, MasterCard Platinum), American Express, JCB and China Unionpay.

These are cards designed for transactions on the Internet. They do not have a magnetic strip and a chip, they cannot be used in ATMs and terminals. The owner will not be able to receive cash at the bank's cash desk, except when the card is closed if there is a positive balance on it.

According to the type of funds placed on the card, they are debit and credit, prepaid and with an allowed overdraft.

The owner of such a card is limited only by the money that is on it. And the money must be his own. For such cards, the bank can set a minimum balance level: a certain amount, upon reaching which the client cannot make transactions until the account balance is replenished.

Debit cards come with an overdraft: they allow you to make transactions, exceeding the limit of your own funds, that is, go into the red. The amount of the overdraft is fixed and negotiated in the contract. Such cards are often tied to accounts. salary projects. The issued loan is repaid automatically upon transfer wages. The fee for the loan begins to accrue from the moment the limit of own funds is exceeded until the required amount is credited to the account.

Credit cards have a certain amount of funds provided by the bank to the client. From ordinary loan products these cards, firstly, differ in that they almost always have a grace period (from 30 to 100 days), during which no interest is charged on paid purchases. Second, credit card interest (which accrues after grace period) is several points higher than for a conventional loan.

The amount of money loaned on a credit card is individual for each client. The cardholder can use the funds as needed, and interest will only accrue on the amount actually used. A feature of this card is that it does not assume the presence of a positive balance. For periods when credit funds are not used and there is no debt on the account, no commission is charged (except for payment additional services, for example, mobile bank). Note that when withdrawing cash from an ATM, a fee may be charged.

Bank cards have categories, they depend on financial investments bank customer. If a client makes a lot of transactions with large amounts or he has a lot of money in his account, he can be offered (or he can issue such a card if he wants) Gold, Platinum, VIP and others statuses. In most cases, all clients receive Classic status when they open an account. The higher the category of the card, the more opportunities it has and the more privileges it provides to the holder (discounts, service priority, concierge services, etc.). But at the same time, the cost of service increases in proportion to the category of the card.

Depending on the purpose, cards can be salary, corporate, prepaid, pre-issued and gift cards.

Salary cards are issued to employees of companies within the framework of salary projects.

Corporate cards are issued for the purpose of making operational purchases and paying for services by company employees in its interests (for example, paying for restaurants, gas stations, car washes, etc.). Cash the card account belongs to the company, and employees using it must provide reports confirming the intended use of funds.

A prepaid bank card is a card on which there is a certain amount, and payments are made on behalf of the issuing bank. These cards usually have short term actions that do not allow you to cash out funds and replenish your account.

A pre-issued bank card is a card that is issued even before an application for receipt is written and is attached to an account that is opened for a specific client. Such a card initially does not contain information about its owner, it does not indicate the full name. The card makes it possible to perform the same operations as a regular debit card, including using an online bank, and receiving interest on the balance of funds. Making payments using such cards does not require the presentation of documents.

Gift cards are non-rechargeable and do not allow you to withdraw cash. The funds available on it can only be used to pay for the purchase.

A bank card is the most convenient, practical and reliable payment instrument that has become an integral part of life modern man. For many users, it not only gives access to their bank account, but also gives many opportunities in the form of discounts, bonuses and other privileges. Consider what a bank card is, what types of them exist.

A bank card is a personal payment instrument that gives its owner access to his bank account, debit or credit. With its help, you can make non-cash payments for goods and services, including on the Internet, withdraw cash at the cash desks of banks or ATMs.

Bank cards appeared in human life not so long ago, only 60 years ago, today they are used all over the world and are gradually replacing cash. By the way, before the advent of "plastic", the system of cashless payments existed in the form of checkbooks, which today has already gone down in history completely.

A number of requirements are imposed on a plastic product of any issuing bank, first of all, the size according to the ISO 7810 ID-1 standard, namely, width - 86 mm, length - 54 mm, thickness up to 1 mm, corner radius - 3.18 mm.

Compared to cash, cards provide their owner with a number of advantages:

A payment card is just a tool or a key to a bank account to your own or a bank one. In the first case, the card is debit, that is, the user spends only his own funds, in the second, the cardholder uses a loan.

All bank cards are divided into several types according to the type of calculation:

Not so long ago, banks began to offer customers completely New Product- this is virtual card, unlike real "plastic", it does not have a physical carrier. This product is useful for those who make purchases through online stores. The bank issues only details to the client.

Appearance of a bank card

So, what does the card look like, its design and main elements on the front side:

On the reverse side:

Perhaps not everyone knows, but the issue of plastic bank cards is regulated by the Regulation of the Central Bank of the Russian Federation "On the issue of bank cards and on operations performed using payment cards."

We all quite often use bank payment cards to pay for goods or services, but not everyone knows exactly how the settlement mechanism between the issuing bank and the seller takes place.

Consider this diagram:

The process of issuing cash through self-service devices - ATMs - looks similar.

How is the payment using a bank card: scheme

In general, what is a payment card? This is a cashless payment facility that allows its owner to make any settlement transactions without attracting cash. At the moment, credit cards are most in demand, that is, cards with credit limit. They are primarily a spare wallet for their owner, and also allow you to use borrowed funds during a grace period without interest.

There are many definitions of what a bank card is, but their meaning is as follows: it is a convenient universal tool for accessing your bank account, it is also called a special bank account(SCS). The card makes sense only in tandem with your bank account, and all operations are carried out with it (payment at a point of sale or on the Internet, cash withdrawals from an ATM, transfers and accruals). And to put it more correctly, the above operations with money (debit or replenishment) are reflected on the card account.

Hence follows important point- there is no money on the plastic itself, there is only encoded digital information (on a magnetic stripe or in a chip), which is transmitted to the bank using all sorts of "cunning" protocols, and he already decides whether to give you money through an ATM or allow payment for goods in shop (any action on the map starts with). Simply put, a bank card is the key to money, not the money itself. This, by the way, is one of its advantages.

All this kitchen with the exchange of information and other things is more interesting for a techie, but it is enough for an ordinary cardholder to know that the payment system (PS) is responsible for all this. That is why on the map you can see not only the name and logo of the bank, but also in without fail image payment system(often these are international SS Visa or MasterCard, less often - local domestic (national) SS Sberkart, Gold Crown and etc.). In fact, the payment system is an intermediary between you and the bank, providing the possibility of paying with a bank card everywhere (of course, within its presence).

If we are already talking about the exchange of information, then it is important to note the fact that a card without modern means and communication capabilities (Internet, etc.) becomes a beautiful piece of plastic (or more noble material if the card is privileged), although it used to be done without it ( read about slips and embossing).

It is interesting that the bank that issued the card () is its owner (that is, by and large, you must return the bank card back to the bank after its expiration date or if you wish to close it), but does not have the right to manage the cardholder's money (only under a card agreement or by a court decision).

You can fully use the card after it.

6. Card authentication code only on American Express cards. It is usually located on the back side of the plastic (see 11).

7. Chip- this is a microprocessor with external contacts removed (in fact, this is a small computer). The chip contains information on the card in the form of digital data and, unlike the magnetic strip, has an increased level of security. For example, if data from a magnetic stripe can be copied by creating a clone card, then such an operation will not work with a chip - it uses hardware and software protection against hacking. Cards with one chip are almost never found in Russia - usually banks issue combined bank cards - and with a magnetic stripe.

8. Bank logo- can be placed anywhere on the map, it depends on the design decision. The logo indicates that the card belongs to the bank that issued it (issuing bank). Usually the logo contains the name of the bank in an abbreviated form.

The reverse side of a bank card usually looks like this:

9. Information about the bank- at the bottom of the reverse side of the card, information of the following nature is usually provided: the card was issued by a bank such and such (its name) and only the owner of the card has the right to use it. Often here you can find a free phone hotline to communicate with the contact center specialists.

10. Paper strip for signature– located immediately below the magnetic strip (12). It is available on any cards, even non-personalized ones. The absence of a signature on this strip can lead to the refusal of the cashier to accept the card (sometimes this happens), which the bank warns about in small print under the paper strip in Russian, English and French: “Sample signature, without a signature is not valid.” On the other hand, the presence of a signature, albeit ineffective, but protection against the use of plastic by an attacker (in this case, it is necessary to verify the signature of the cardholder with the signature on it during each purchase - but is it reasonable and realistic?).

Usually on a paper strip there is the last group of four digits of the card number with an inclination to the left (you can also meet the entire number) and followed by 3 digits of the authentication code (security code).

The design of the strip can be different: plain or filled with diagonal lines with the words Visa or MasterCard (depending on the payment system of the card).

11. Card authentication code(CVV2 / CVC2), it is also a secret code - consists of 3 digits and is called CVV2 (for Visa cards) or CVC2 (for MasterCard cards). It is usually placed on a small white paper strip, next to the holder's signature strip after the last four digits of the bank card number. The font is tilted to the left.

This code is used when making payments on the Internet (online stores and any online purchases) to verify the authenticity of the card as an additional security element, which significantly increases the security of calculations. It may not be available on cards with entry-level payment systems (Maestro, Cirrus, Electron); the holder will not be able to pay with such a card on the Internet.

12. Magnetic stripe- This is a strip with digital data on a magnetic storage medium. Data is recorded on it only once during the issuance of the card by the bank and contains the information necessary for the calculation of this card.

Benefits of bank cards:

Primarily, plastic card replaces cash(especially a trifle), but it does not create inconvenience, because. payment for it in outlets for its holder it happens without a commission (the stores themselves pay a significant commission according to the rules of payment systems - an average of about 2% per operation). Large money also does not need to be carried with you, they are all safe in a bank account.

From here follows no need to declare a large amount of money during a trip to another state(at customs) – cards are not subject to customs registration.

loss or Credit card theft is no longer a problem compared to the loss of a wallet with money - the card can be quickly blocked by calling the bank or by SMS (the holder should always know how to block his card). The fraudster (or the one who found it) will no longer be able to use it, the bank will issue you new card with the same amount in your account.

If you have an international payment system (IPS) card, then you won't have problems paying abroad in most countries of the world where this MEA operates. Your funds will automatically be transferred to local currency at the established exchange rate of the bank (with a possible small commission). You can also pay online.

Any payments will go through quickly no matter what country you are in. Also easy You can withdraw money from any ATM(with the logo of your payment system).

holder can replenish your account quickly and without interest through payment terminals or ATMs with the function of accepting cash, without wasting your time in queues at the bank's cash desk.

If the cardholder is Abroad, then replenishment of the card account is The best way transfer money to him, unlike systems instant translation who charge a certain percentage for this service.

Disadvantages of bank cards:

The main disadvantage is lack of 100% security when making payments at retail outlets and on the Internet. The point here is not even in the standards and data exchange protocols used, but in the targeted actions of attackers aimed at stealing card details (especially on the Internet). They use many illegal methods and the defense against this is financial literacy and care of the cardholder.

Some transactions may come with a fee., for example, payment abroad in foreign currency. It is important to have an idea about such operations and be sure to specify the amount of the commission.

The rest of the shortcomings are rather the underdevelopment of the plastic settlement infrastructure: the cards are still not accepted in all stores; some the complexity of the application while working with an ATM(especially for the elderly); tip payment problems(in Russia, this is not as developed as in Europe and the USA, where a separate line in the check is provided for tips and they are carried out as a separate payment).

Separately, it can be noted that All card purchases are not anonymous, this information is available to the authorities.

[Total: 2 Average: 5]

Subscribe to new articles

New articles of the site "Finance for People" with delivery to your mail!

Modern society actively practices plastic cards in 2015 in everyday life and business. They allow you to quickly pay for services and goods, receive discounts, bonuses and are a tool for identifying a person. Plastic cards have many categories, depending on the purpose, type and functionality. The article contains detailed information about payment and non-payment plastic products.

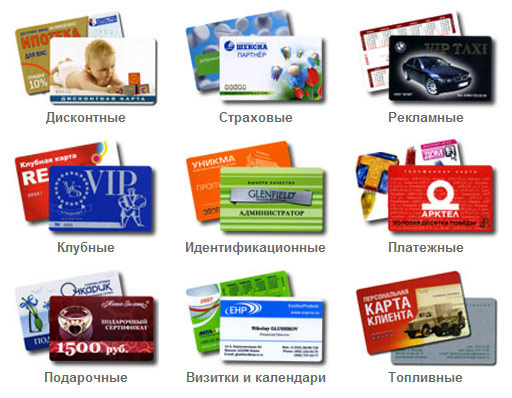

The inhabitants of the country in use have a lot of cards, each of which has a certain history, quality, features and disadvantages. Depending on the purpose, all these products are payment and non-payment. Non-payment type of plastic cards includes:

Payment cards depend on the manufacturing organization and, accordingly, are classified:

Taking into account the legal status of the holder, cards have been developed:

Bank plastic cards with money, depending on their functionality, are divided into categories:

Subject to types banking clients, the cards differ in services, additional bonuses and discounts. The more prestigious the product, the higher its cost. The following classes exist:

An electronic card is linked to a bank account and is an electronic carrier. It should be noted that one plastic can support a single payment association. Based on payment systems, within which cards are serviced, the following financial products can be distinguished:

Today, there are no special differences between Mastercardi Visa plastic cards of the corresponding classes. When traveling abroad, you can link an account opened in desired currency. If the money on the foreign currency account runs out, debiting from the account in Russian rubles at the exchange rate set by the bank.

Most of the information is printed on the front of the card. The long number, which most often contains 16 digits, contains the following information about the banking product:

The card also indicates the expiration date of the product. The reverse side contains the seven-digit card number or the last four digits contained in it. In addition, there is a three-digit CVC code for making online payments.

Features of plastic cards issued by other institutions are reflected by the initial digit of the number. It testifies to the activities of the company that issued the card:

During the development of the market, a lot of innovative technologies appeared with plastic cards. For informational purposes, the cards contain the following technical elements.

It should be noted that most cards contain several technical devices.

Among the listed technologies used by financial institutions, smart cards are the most promising. They have a microscopic circuit with a processor, an operating system, memory, and a device that controls the input and output of data.

Today, plastic card markets are saturated with smart plastic. Russia supports two ways of information reading with the help of the following products:

Such smart cards are characterized by: